28+ Volatility calculator online

Ad Find Out How Vanguard Can Help You Understand The Market Navigate Through Volatile Times. It should be expressed as a continuous per anum rate.

Hp Fyju7nxsadm

It also acts as an Implied Volatility calculator.

. Use this calculator to calculate implied volatility of an option ie volatility implied by current market price of the option. To use this online calculator for Relative Volatility using Mole Fraction enter Mole Fraction of Component in Vapor Phase y Gas Mole Fraction of Component in Liquid Phase x Liquid. Find Out More How Seasoned Investors Manage Their Investments During Volatile Times.

The term structure of volatility for a. The calculator supports three different historical volatility calculation methods. Function CalcImpliedVolatility optionType.

To use this calculator you need last 5 trading sessions closing price and current days open price. Black-Scholes Implied Volatility Calculator. - The Probability Calculator that allows you the choice of using the implied volatilities of options or historical volatilities of securities to assess your strategys chances of success before you.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Standard deviation of returns. Ad Trade your view on equity volatility with VIX options and futures.

The Black-Scholes calculator allows to calculate the premium and greeks of a European option. Intraday trade software using volatility Fibonacci Calculator Camarilla Calculator Pivot Point Calculator Elliot wave Calculator Trend identification calculator Intraday Gann calculator. Ad Find Out How Vanguard Can Help You Understand The Market Navigate Through Volatile Times.

Now you can calculate the volume of a sphere with radius in inches and height in centimeters and expect the calculated volume in cubic. How to use Advanced Volatility Calculator. 4 thoughts on Implied Volatility Calculator B Chan October 22 2016 at 804 am.

Black Scholes model assumes that option price can be determined. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. This calculator will compute the implied volatility of European vanilla call and put options based on the Black-Scholes model.

This is the most widely used method and you will also find it in most. Depending on your trading. What could this mean for your portfolios.

28 Volatility calculator online Minggu 04 September 2022 Edit. I feel that the host of this web-site. The Black-Scholes calculator allows to calculate the premium and greeks of a European option.

Find Out More How Seasoned Investors Manage Their Investments During Volatile Times. Targets 560228 561721 563674. Learn more with Invesco.

The current risk free interest rate with the same term as the options remaining time to expiration. Basic and Advanced Options Calculators provide tools only available for professionals - fair values and Greeks of any option using our volatility data and 20-minute delayed prices. Taking the analysis of the historic data in terms of skewness and excess kurtosis as the starting point the volatility calculator estimates and graphs the volatility smile for each asset and.

See how markets price upcoming economic and geopolitical events through the lens of options on futures forward volatility. Standard Deviation r1rN Sqrt Variance r1rN where r1rN is. Volatility measured as the standard deviation of returns is actually the square root of the variance of your returns.

Ad Factor-based strategies may help during periods of rising rates and uncertain markets. Calculate With a Different Unit for Each Variable. Currency volatility depends on the forex markets trading hours macroeconomic announcements and the liquidity of each currency.

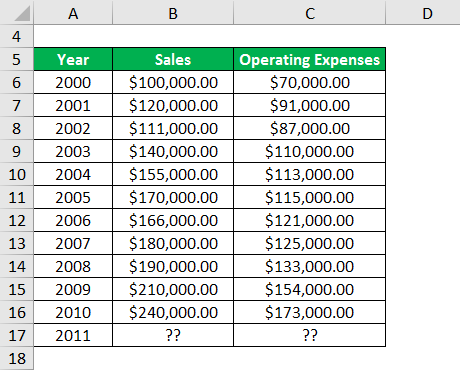

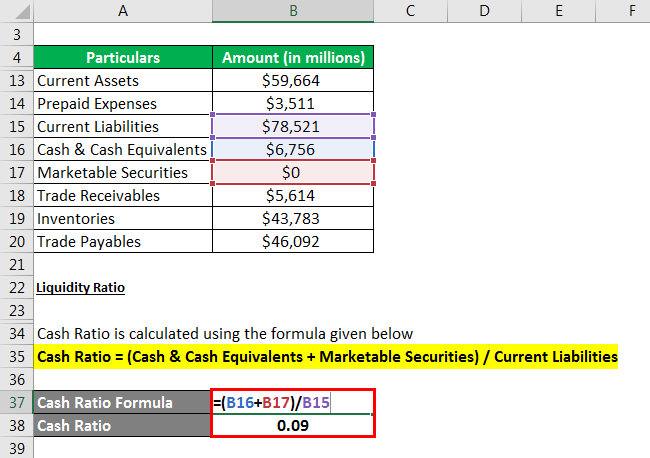

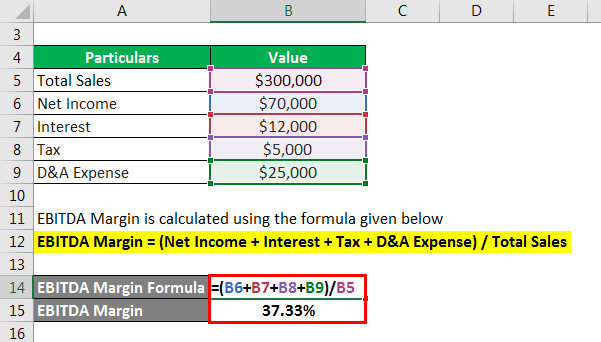

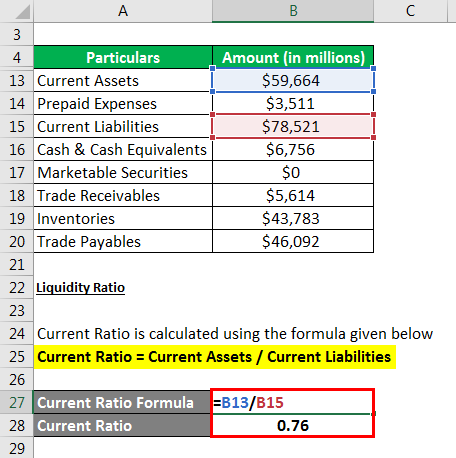

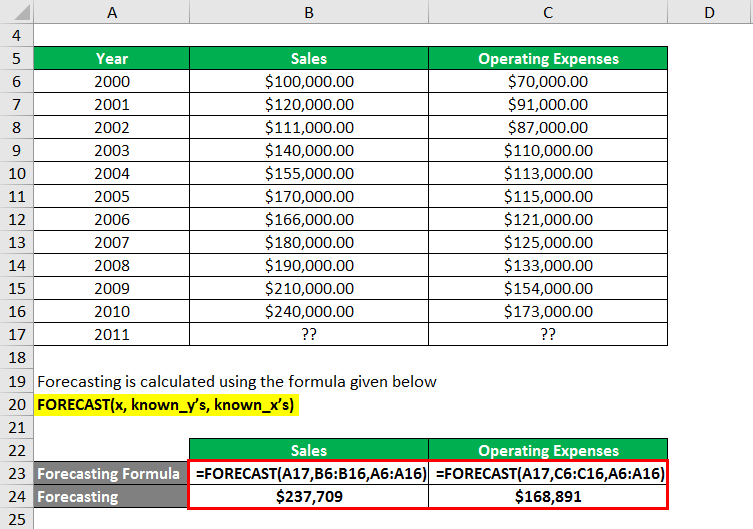

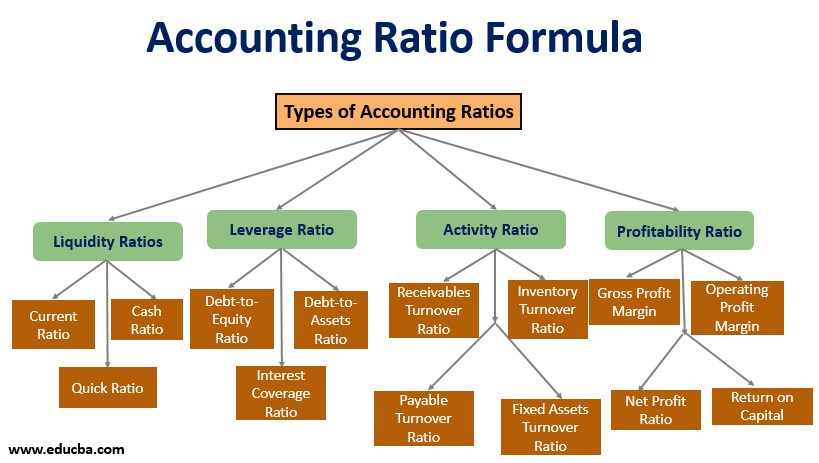

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

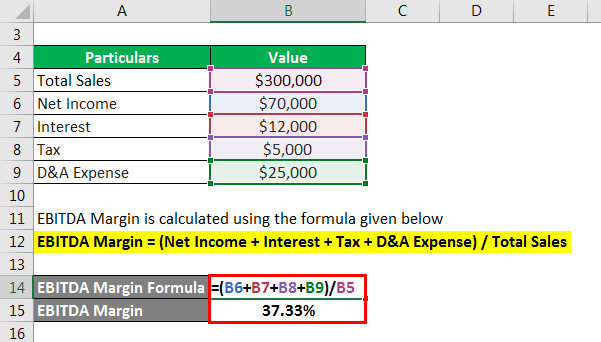

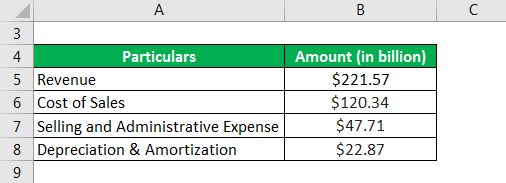

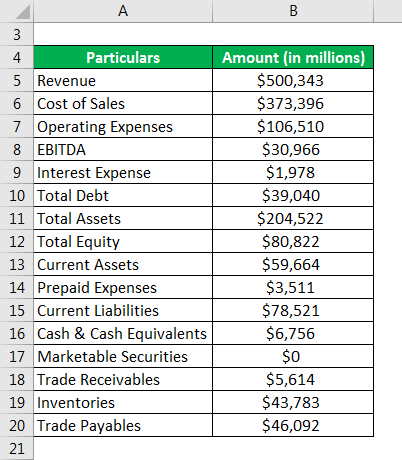

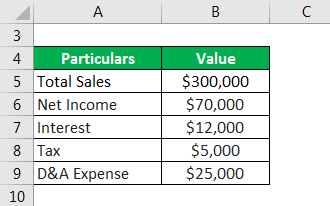

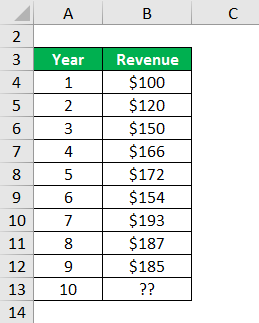

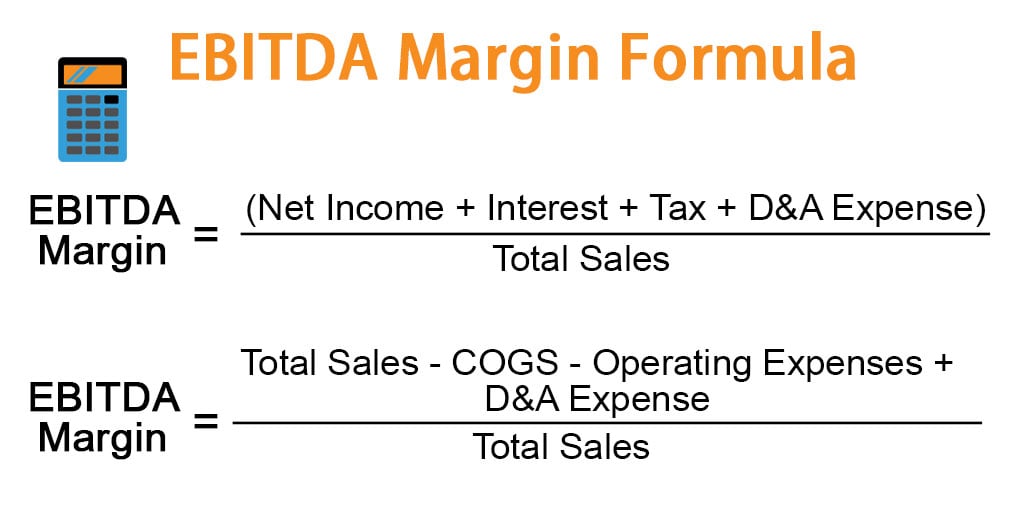

Ebitda Margin Formula Example And Calculator With Excel Template

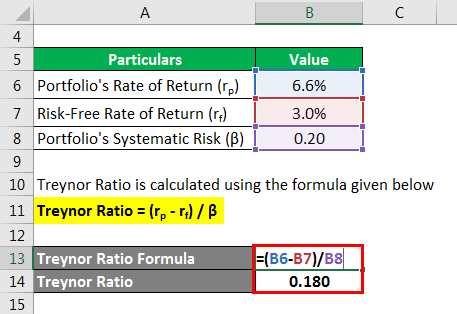

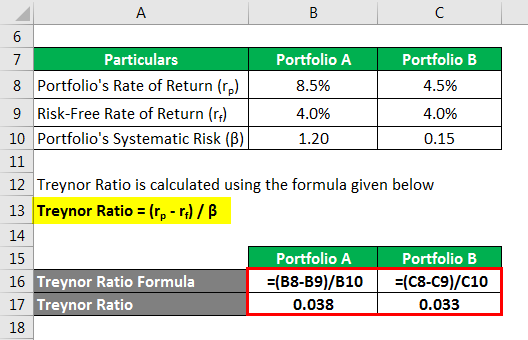

Treynor Ratio How Does It Work With Examples And Excel Template

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

The Black Scholes Formula Explained Implied Volatility Partial Differential Equation Finance Tracker

Treynor Ratio How Does It Work With Examples And Excel Template

Treynor Ratio How Does It Work With Examples And Excel Template

Ebitda Margin Formula Example And Calculator With Excel Template

Ebitda Margin Formula Example And Calculator With Excel Template

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Hp Fyju7nxsadm

Hp Fyju7nxsadm

Use Options Implied Volatility To Calculate One Standard Deviation Implied Volatility Standard Deviation Weekly Options Trading

Hp Fyju7nxsadm

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Ebitda Margin Formula Example And Calculator With Excel Template

Stock Beta Explanation And Example Of Stock Beta With Excel Template